- All

- Product Name

- Product Keyword

- Product Model

- Product Summary

- Product Description

- Multi Field Search

Views: 16 Author: Site Editor Publish Time: 2021-01-26 Origin: Site

Over time, the Covid-19 has become a pandemic worldwide, and the situation is grim. The flow of factors such as global personnel, commodities, and technology has slowed down, and downward expectations such as international trade and supply chain fluctuations have increased. The supply-demand relationship, price fluctuations and global capital markets, futures markets, and financial markets have also been impacted and affected in the international bulk commodity market.

Global furniture production and trade situation.

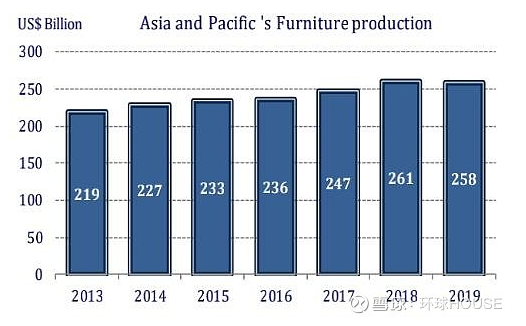

The Asia-Pacific region is still the main force in furniture production, accounting for 50% of the world. The region's furniture production declined in 2019, with a total of approximately $260 billion. In 2019, China's total furniture production accounted for 37% of the world's total, a decrease of 2 percentage points from 39% in 2018.

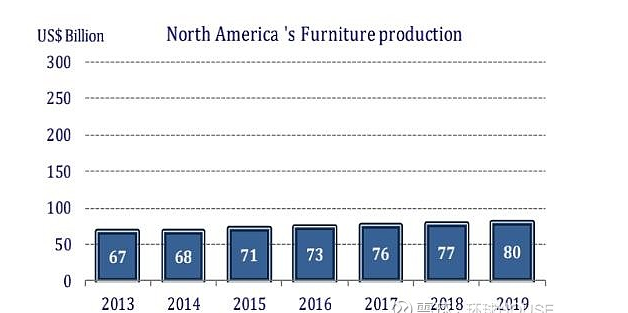

North America continued its previous growth trend in 2019, and the growth rate began to accelerate

The economic recession in South America in recent years has not yet dissipated, and the furniture industry is still recovering.

The furniture industry in the Middle East and Africa belongs to the underdeveloped ranks, and in 2019 it still only accounts for a very small proportion in the world.

In recent years, the situation of the global furniture industry has undergone some changes, and the product flow and value chain are being reshaped.

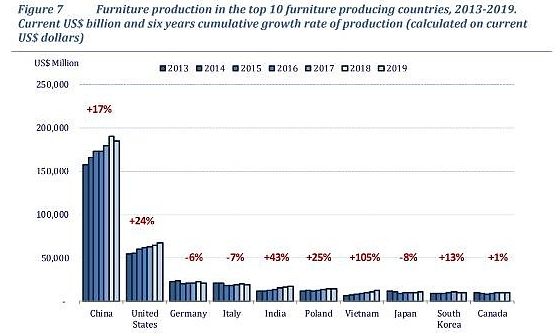

Among the top ten countries in the global home furnishing production: China, the United States, Germany, Italy and other countries are large traditional furniture production countries, but India, Poland, Vietnam have developed rapidly in furniture production in recent years, especially the growth rate of Vietnam is very considerable. India's increased domestic consumption level and huge market demand have stimulated a substantial expansion of the furniture industry. I will analyze the specific situation in detail in the chapter on the global furniture market. The situation in Poland and Vietnam is just the opposite. These two countries have advantages in furniture exports and increased their furniture output by expanding their share of the international furniture market.

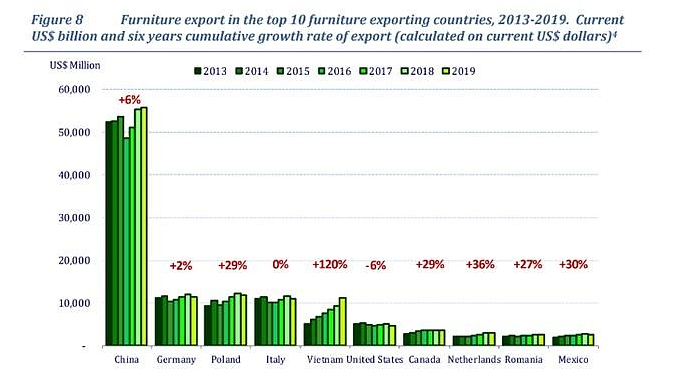

Among the top ten countries in furniture export, China is still far ahead and in the first place (in 2019, the cumulative export of Chinese furniture was 56.09 billion U.S. dollars, an increase of 0.96% year-on-year, accounting for about 35% of total global exports). Poland’s furniture exports surpassed Italy, and Vietnam’s exports more than doubled. With the development and stability of emerging furniture production areas, we can predict that there will be new important players in the global furniture industry in the future. The outflow of furniture products worldwide will expand from Western Europe, East Asia, North America and even move to Eastern Europe and Southeast Asia.