- All

- Product Name

- Product Keyword

- Product Model

- Product Summary

- Product Description

- Multi Field Search

Views: 18 Author: Site Editor Publish Time: 2019-06-18 Origin: Site

The global office furniture market is on a steady growth trend, with research site Fact.MR, projecting a CAGR of 5.8% through 2022 for the industry, surpassing $30.5 billion.

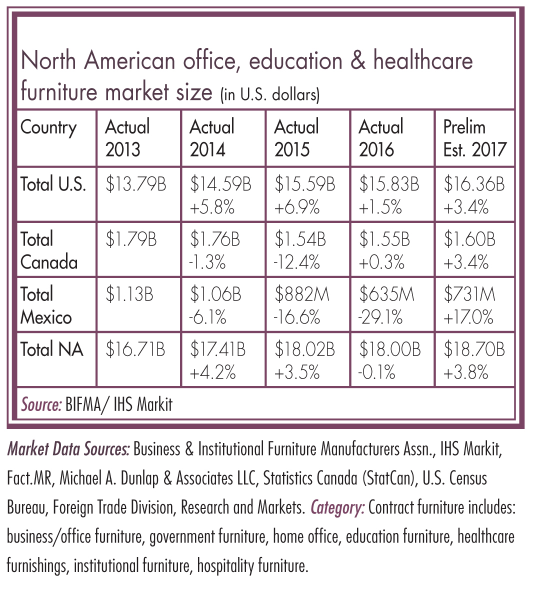

North America continues to rank among the top producers in the global contract furniture arena, with consumption of office, education and healthcare furniture estimated at $18.70 billion in 2017, the most recent figures published by BIFMA/IHS Markit. Analysts predict the overall growth of the North American market will continue to rise.

The ability to sustainably manufacture product, plus react quickly to changing workplace trends, gives North American manufacturers a competitive advantage. As seen at NeoCon, current office trends include: privacy on demand within the open plan workplace, incorporating partitions and mobile pods; adaptive furnishings that can be reconfigured for collaborative or private work requirements; biophilic design which incorporates natural materials and natural light into the office environment; plus even more height-adjustable desks, innovative surface materials, and products for acoustic comfort.

Manufacturers must also deal with a number of items impacting the industry, including: tariffs; U.S. formaldehyde emissions regulations, with Canada and Mexico looking to do the same; furniture flammability regulations; seating and storage standards; and issues relating to sustainability in the workplace.

According to Research and Market’s Office Furniture World Market Outlook, eight countries account for about 80% of the total output, with China, the U.S. and Germany leading the way.

Domestically, the contract furniture market is moving at a steady pace, according to the October 2018 MADA/OFI Trends Survey, conducted by Michael A. Dunlap & Associates LLC. In addition to respondents’ concerns on healthcare costs, the most frequently cited perceived threats were tariffs, transportation and logistics costs, steel prices, and general material costs.

Seating and systems each account for 28% of office furniture products by category, according to BIFMA 2015 information. Tables are roughly 12% of the product mix, followed by files and casegoods at 11% each, and storage at 5%. Other types of products account for the remaining 5%.

According to research published by Fact.MR, the global office furniture market is projected grow at 5.8% CAGR through 2022, surpassing $30.5 billion by the year’s end. Office chairs are expected as the top selling product, surpassing $8.8 billion by end 2022.